Introduction

Cash flow analysis is a vital tool for businesses to understand and manage their financial health. It provides insights into the inflows and outflows of cash, allowing businesses to make informed decisions about budgeting, investing, and strategic planning. This beginner’s guide explores the importance of cash flow analysis, key components to consider, and practical examples of how businesses can effectively analyze and interpret their cash flow.

The Significance of Cash Flow Analysis

Measuring Financial Health

Cash flow analysis provides a clear picture of a company’s financial health by evaluating the movement of cash within the business. It assesses the ability of a company to generate sufficient cash to cover operating expenses, debt obligations, and investments. As entrepreneur and investor Robert Kiyosaki once said, “Cash flow tells the story of how a business handles money.”

Identifying Cash Surpluses and Shortages

Analyzing cash flow helps businesses identify periods of cash surpluses or shortages. Surpluses indicate that a company is generating more cash than it needs for its operations and can consider options such as expansion, debt repayment, or investment. Shortages, on the other hand, highlight the need to address cash flow issues, potentially through cost-cutting measures, improved revenue generation, or obtaining additional financing.

Key Components of Cash Flow Analysis

Operating Cash Flow

Operating cash flow represents the cash generated or used in the day-to-day operations of a business. It includes cash received from sales, cash paid to suppliers, employee wages, rent, utilities, and other operating expenses. Analyzing operating cash flow helps businesses understand their ability to generate consistent cash from their core operations.

Investing Cash Flow

Investing cash flow reflects the cash used or generated from investments in assets such as property, equipment, or acquisitions. Positive investing cash flow indicates that a business is investing in growth opportunities, while negative investing cash flow may suggest divestment or asset disposals. Analyzing investing cash flow helps businesses assess their investment strategies and the impact on overall cash flow.

Financing Cash Flow

Financing cash flow represents the cash generated or used through financing activities, such as obtaining loans, issuing or repurchasing stock, or paying dividends. Positive financing cash flow indicates that a business is raising capital, while negative financing cash flow may suggest debt repayment or shareholder distributions. Analyzing financing cash flow helps businesses evaluate their capital structure and funding sources.

Effective Cash Flow Analysis

Cash Flow Statement

To conduct a cash flow analysis, businesses need to prepare a cash flow statement. The cash flow statement outlines the cash inflows and outflows for a specific period and is divided into operating, investing, and financing activities. It provides a comprehensive view of a company’s cash position and its sources and uses of cash.

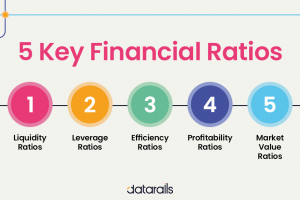

Cash Flow Ratios

Cash flow ratios help interpret the cash flow statement and assess a company’s financial performance. Common cash flow ratios include the operating cash flow ratio, free cash flow ratio, and cash flow coverage ratio. These ratios provide insights into a company’s ability to generate cash, its liquidity, and its ability to cover financial obligations.

Interpreting Cash Flow Analysis

Positive Cash Flow vs. Negative Cash Flow

Positive cash flow indicates that a business is generating more cash than it is spending, allowing for reinvestment, debt reduction, or profit distribution. Negative cash flow implies that a business is spending more cash than it is generating, which may require external financing or cost management strategies. It is essential to understand the reasons behind positive or negative cash flow and take appropriate actions accordingly.

Seasonality and Cash Flow

Many businesses experience seasonal fluctuations in cash flow due to factors such as consumer behavior, industry trends, or weather conditions. It is crucial to account for these fluctuations in cash flow analysis to ensure adequate cash reserves during lean periods and effective utilization of excess cash during peak seasons.

Conclusion

Cash flow analysis is a fundamental aspect of financial management for businesses of all sizes. By evaluating the movement of cash within a company, businesses can gain insights into their financial health, identify cash surpluses or shortages, and make informed decisions about budgeting, investing, and strategic planning. As business magnate and philanthropist Bill Gates once said, “Success is a lousy teacher. It seduces smart people into thinking they can’t lose.” Effective cash flow analysis helps businesses avoid financial pitfalls and maintain long-term sustainability.