Introduction

Debt ratios are essential financial metrics that provide insights into a company’s debt management and financial stability. By analyzing these ratios, businesses can assess their ability to meet debt obligations, evaluate risk levels, and make informed decisions about financing and investment. This comprehensive guide explores the importance of debt ratios, key types of ratios, and practical examples of how businesses can effectively analyze and interpret their debt ratios.

The Significance of Debt Ratios

Assessing Financial Health

Debt ratios are key indicators of a company’s financial health. They help assess the company’s leverage, solvency, and ability to manage debt. As billionaire investor Warren Buffett once said, “It’s only when the tide goes out that you learn who has been swimming naked.” Debt ratios reveal vulnerabilities and potential risks, allowing businesses to take proactive measures to improve their financial position.

Evaluating Risk Levels

Debt ratios provide valuable insights into the risk levels associated with a company’s debt. By understanding the proportion of debt in relation to assets, equity, or cash flow, businesses can assess their capacity to handle financial shocks and market downturns. Analyzing debt ratios helps businesses make informed decisions about taking on additional debt or managing existing debt levels.

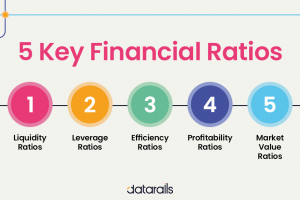

Key Types of Debt Ratios

Debt-to-Equity Ratio

The debt-to-equity ratio measures the proportion of debt financing relative to equity financing. It indicates the extent to which a company relies on debt to finance its operations. A higher debt-to-equity ratio suggests a higher financial risk and dependence on borrowed funds. Conversely, a lower ratio indicates a lower risk and a greater reliance on shareholder equity. This ratio is calculated by dividing total debt by total equity.

Debt-to-Asset Ratio

The debt-to-asset ratio assesses the proportion of a company’s assets that are financed by debt. It reflects the level of financial leverage and risk associated with a company’s debt. A higher debt-to-asset ratio indicates a higher risk and a larger proportion of debt-funded assets. Conversely, a lower ratio suggests a lower risk and a larger proportion of equity-funded assets. This ratio is calculated by dividing total debt by total assets.

Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to meet its interest payments on outstanding debt. It assesses the company’s capacity to generate sufficient operating income to cover interest expenses. A higher interest coverage ratio indicates a healthier financial position, as the company has a greater ability to meet interest obligations. A lower ratio suggests higher financial risk and potential difficulty in servicing debt. This ratio is calculated by dividing operating income by interest expenses.

Effective Debt Ratio Analysis

Comparative Analysis

Comparing debt ratios within an industry or against competitors provides valuable insights into a company’s financial position. By benchmarking against industry standards, businesses can determine if their debt levels are in line with peers or if they require adjustments. It is essential to consider industry-specific factors and market conditions when conducting comparative analysis.

Trend Analysis

Analyzing debt ratios over time helps identify trends and patterns in a company’s debt management. It allows businesses to assess their progress in reducing debt levels, improving financial stability, or identifying potential warning signs. Trend analysis provides a long-term perspective and helps businesses evaluate the effectiveness of their debt management strategies.

Interpreting Debt Ratios

Optimal Debt Levels

There is no one-size-fits-all answer to the optimal debt levels for businesses. It depends on various factors, including industry dynamics, business lifecycle stage, and risk appetite. As financial expert Suze Orman once stated, “A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life.” Businesses need to strike a balance between leveraging debt for growth and ensuring manageable debt levels to avoid undue financial stress.

Risk Assessment

Debt ratios play a crucial role in assessing a company’s risk profile. Businesses should consider both quantitative and qualitative factors when interpreting debt ratios. While low debt ratios may indicate a conservative approach, they may also signal missed growth opportunities. Conversely, high debt ratios may indicate potential financial strain but can be justified if accompanied by strong cash flow generation and investment returns.

Conclusion

Debt ratios are valuable tools for businesses to assess their financial health, evaluate risk levels, and make informed decisions about debt management. By understanding and interpreting these ratios, businesses can identify areas for improvement, optimize their capital structure, and enhance their overall financial stability. As business magnate and philanthropist Richard Branson once said, “Never take your eyes off the cash flow because it’s the lifeblood of business.” Effective analysis of debt ratios ensures businesses have a solid foundation for sustainable growth.