As Warren Buffet wisely remarked, “Risk comes from not knowing what you’re doing.” In the realm of investing, ignorance is not bliss, but a potential path to financial loss. Understanding how to use financial analysis for investment decisions is fundamental to success. Let’s delve into the nuances of financial analysis, its application in investment decisions, and real-world examples to understand it better.

Understanding Financial Analysis

Financial analysis is the evaluation of a business’s financial performance and stability. It involves interpreting financial statements to gain an understanding of the financial health of a business, its prospects for the future, and its intrinsic value. It involves considering factors such as profitability, liquidity, efficiency, stability, and return on investment.

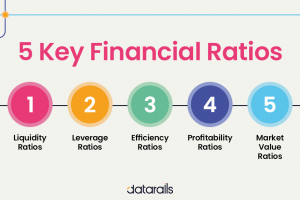

Key tools used in financial analysis include:

- Ratio Analysis: Ratio analysis involves comparing different figures from a company’s financial statements. Ratios can be categorized into profitability ratios, liquidity ratios, leverage ratios, efficiency ratios, and valuation ratios.

- Cash Flow Analysis: This involves assessing a company’s cash inflows and outflows to determine its liquidity and long-term solvency.

- Trend Analysis: This involves analyzing the company’s financial performance over time to identify trends that may predict future performance.

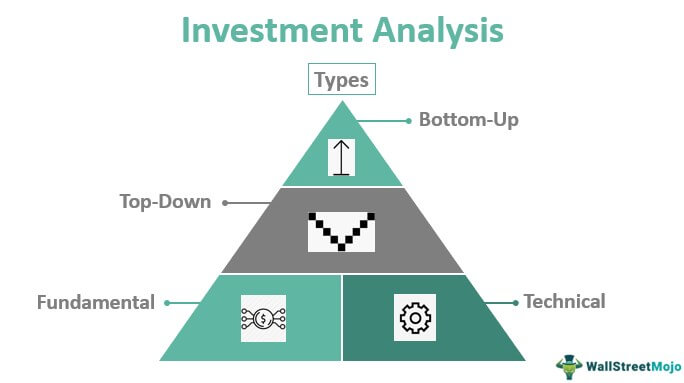

Applying Financial Analysis in Investment Decisions

Investors use financial analysis to determine whether a company is a good investment opportunity. Here are some ways financial analysis is applied:

- Evaluating Profitability: Profitability ratios like Return on Assets (ROA) and Return on Equity (ROE) help investors understand a company’s ability to generate profits.

- Assessing Liquidity: Liquidity ratios like the current ratio and quick ratio help determine a company’s ability to meet short-term obligations, which could impact its stability.

- Understanding Efficiency: Efficiency ratios like inventory turnover and asset turnover give insights into how effectively a company utilizes its resources.

- Determining Solvency: Debt ratios and the cash flow to debt ratio can help investors understand a company’s long-term solvency and risk level.

- Estimating Intrinsic Value: Valuation ratios like the Price to Earnings (P/E) ratio and Price to Book (P/B) ratio help estimate a company’s intrinsic value, assisting in identifying overvalued or undervalued stocks.

Financial Analysis in Practice: A Real-world Example

Consider a publicly-traded tech company, TechNova Corp. You’re interested in investing, so you conduct financial analysis.

Looking at profitability, you find the ROA is 15%, higher than its competitors, indicating effective use of assets. The ROE is 20%, suggesting high profitability for shareholders.

The current ratio is 2.0, suggesting solid liquidity, and the debt ratio is 30%, showing a lower reliance on debt financing, which can be a good sign.

Analyzing efficiency, the asset turnover ratio is 1.2, showing a relatively efficient use of assets to generate sales.

Lastly, with a P/E ratio lower than the industry average, TechNova appears to be undervalued.

These signs may lead you to decide to invest in TechNova, based on the results of your financial analysis.

In Conclusion: The Power of Financial Analysis

Financial analysis is a powerful tool in the hands of investors. Understanding how to interpret financial statements and analyze key financial ratios can make the difference between a successful investment and a poor one. As the renowned investor Benjamin Graham said, “The individual investor should act consistently as an investor and not as a speculator.” And this is exactly where financial analysis comes in, providing the sound footing for an investor, rather than a speculator. Remember, the goal of investment should not be mere participation in speculation but in the steady accumulation of wealth over time.

Financial analysis, therefore, serves as your compass in the vast sea of investment options, guiding you towards wise, informed decisions that can lead to financial success.