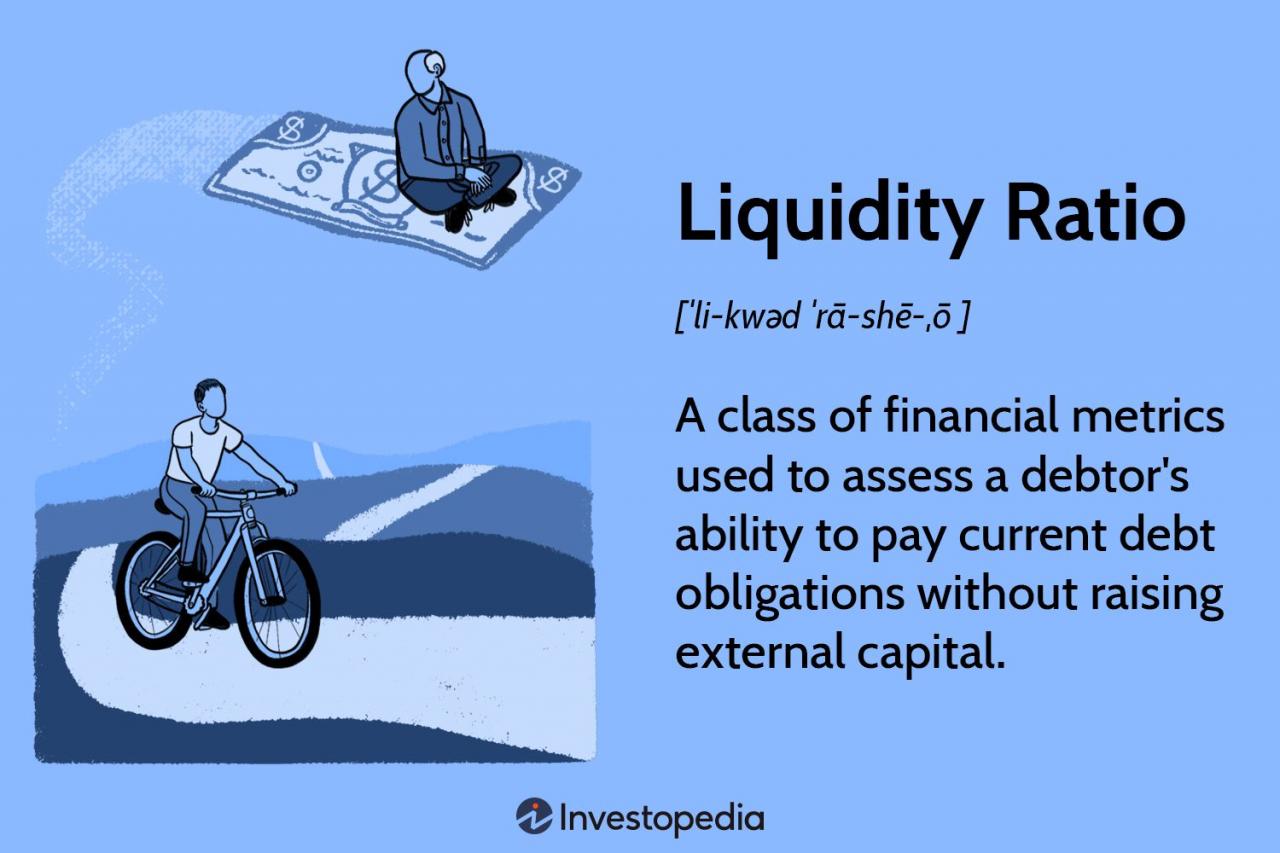

In the words of Benjamin Franklin, “Beware of little expenses. A small leak will sink a great ship.” This statement rings true in the world of finance where understanding a company’s ability to meet its short-term financial obligations – its liquidity – is crucial to assessing its overall health. This is where liquidity ratios come into play. In this article, we’ll delve into the fundamentals of liquidity ratios, their importance, and how to analyze them with real-world examples.

Understanding Liquidity Ratios

Liquidity ratios measure a company’s ability to pay off its current liabilities without relying on the sale of inventory or raising additional capital. High liquidity ratios generally indicate that a company is well-positioned to pay off its debts as they come due. There are three primary liquidity ratios that financial analysts typically focus on: the current ratio, the quick ratio, and the cash ratio.

- Current Ratio: The current ratio compares a company’s current assets to its current liabilities. A higher ratio indicates better short-term financial health. The formula is: Current Assets / Current Liabilities.

- Quick Ratio: Also known as the “acid-test ratio,” the quick ratio is more stringent than the current ratio because it excludes inventory from current assets. The formula is: (Current Assets – Inventory) / Current Liabilities.

- Cash Ratio: The most conservative liquidity ratio, the cash ratio only considers the most liquid current assets: cash and cash equivalents. The formula is: Cash and Cash Equivalents / Current Liabilities.

Interpreting Liquidity Ratios

Each liquidity ratio provides different insights into a company’s short-term financial health. Generally, a higher ratio indicates better solvency, but the ideal ratio may vary depending on the industry.

- Current Ratio: A current ratio under 1 indicates the company may have liquidity issues. However, a very high current ratio may suggest the company is not using its current assets efficiently.

- Quick Ratio: A quick ratio under 1 may indicate potential liquidity problems, considering it doesn’t take into account inventory, which may not be easily liquidated.

- Cash Ratio: A high cash ratio may provide assurance that the company can pay off its debts, but also may indicate the company is not using its cash to further its growth.

Liquidity Ratios in Practice: Real-world Example

Consider a tech company, TechNova Corp, with the following financials:

- Current Assets: $1,000,000 (of which $200,000 is inventory)

- Current Liabilities: $500,000

- Cash and Cash Equivalents: $300,000

Let’s calculate the liquidity ratios:

- Current Ratio: $1,000,000 / $500,000 = 2.0

- Quick Ratio: ($1,000,000 – $200,000) / $500,000 = 1.6

- Cash Ratio: $300,000 / $500,000 = 0.6

These ratios indicate that TechNova Corp is in good short-term financial health, with a good capacity to meet its short-term liabilities.

The Bottom Line: The Importance of Liquidity Ratios

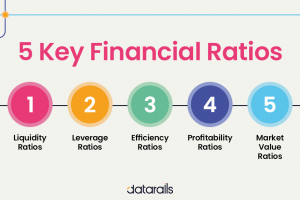

Liquidity ratios are a valuable tool in financial analysis, providing insights into a company’s short-term solvency. However, they are just one piece of the financial puzzle. Other financial metrics, industry trends, and economic conditions should also be considered to make well-informed business and investment decisions.

As a budding entrepreneur or an aspiring investor, understanding liquidity ratios helps you steer the financial ship of your business or investments effectively. In the ocean of business, these ratios are your compass, helping you navigate towards financial stability and success. Remember, in the words of Peter Lynch, “Know what you own, and know why you own it.”