Warren Buffet once said, “Accounting is the language of business.” Understanding financial statements, therefore, is akin to gaining fluency in this language. Financial statements provide a snapshot of a company’s financial health and performance, and are essential tools for business planning, decision-making, and investor reporting. In this article, we will break down the basics of three primary financial statements: the balance sheet, the income statement, and the cash flow statement.

The Balance Sheet: A Snapshot of a Company’s Financial Position

The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It follows the basic accounting equation: Assets = Liabilities + Shareholders’ Equity.

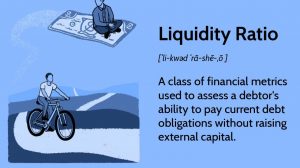

- Assets: These are what a company owns and are categorized into current assets (cash and other liquid items) and non-current assets (long-term investments, property, plant and equipment, and intangible assets like patents).

- Liabilities: These are what a company owes to others. They are split into current liabilities (debts due within one year) and non-current liabilities (debts due in more than one year).

- Shareholders’ Equity: This represents the net value of the company, or the amount that would be returned to shareholders if all the company’s assets were sold and all its debts repaid.

Example: If a company has assets worth $1 million, liabilities of $400,000, it means that the shareholders’ equity is $600,000.

The Income Statement: A Summary of a Company’s Financial Performance

The income statement (also known as the profit and loss statement) shows a company’s revenues, costs, and expenses over a period of time, providing a summary of the company’s financial performance. The bottom line of this statement shows the company’s net income (or net loss), which is calculated as follows: Revenues – Expenses = Net Income.

- Revenue: This is the income generated from normal business operations.

- Expenses: These are the costs incurred in the ordinary course of doing business.

Example: If a company earned $500,000 in revenue and had expenses of $300,000, its net income would be $200,000.

The Cash Flow Statement: A Record of a Company’s Cash Movements

The cash flow statement tracks the movement of cash into and out of the company over a specific period. It’s broken down into three sections: cash flows from operating activities, investing activities, and financing activities.

- Operating Activities: These include transactions that affect the company’s net income, such as payments to suppliers and receipts from customers.

- Investing Activities: These are related to changes in assets, investments, and equipment.

- Financing Activities: These include changes in loans, investments by owners, or dividends paid out.

Example: A company that generates cash from its business operations (positive cash flow from operating activities), spends on new equipment (negative cash flow from investing activities), and pays down debt (negative cash flow from financing activities) would have its cash increase or decrease based on the net effect of these activities.

Decoding the Numbers: The Importance of Financial Statement Analysis

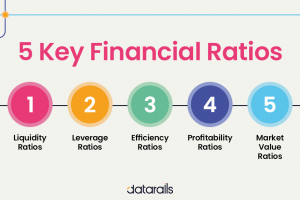

While the figures on financial statements provide raw data, it’s the analysis of these numbers that can yield valuable insights. Ratio analysis, trend analysis, and comparative analysis are some of the tools businesses and investors use to dissect financial statements. By understanding these statements, you’re equipped to make informed decisions about the financial health, performance, and prospects of a business – a vital skill in the corporate world.

As financial guru Peter Lynch aptly put it, “Investing without research is like playing stud poker and never looking at the cards.” Financial statements are your ‘cards’ in the game of business. Play wisely!

Whether you’re a budding entrepreneur, a prospective investor, or a new hire in the finance department, understanding financial statements is a crucial skill. As you navigate through your business journey, let these statements be your financial compass, guiding your decisions and illuminating your path towards growth and success.